Battery Scrap Markets: Trends, Demand & Global Trade Insights

Batteries are the heartbeat of our electrified world—powering EVs, smartphones, and renewable energy grids—but what happens when they die? Enter the battery scrap market, a fast-evolving arena where waste meets wealth. With demand for battery materials surging and sustainability climbing the global agenda, this market is buzzing with trends, opportunities, and trade shifts. Let’s dive into what’s driving battery scrap today and how it’s reshaping the industrial landscape.

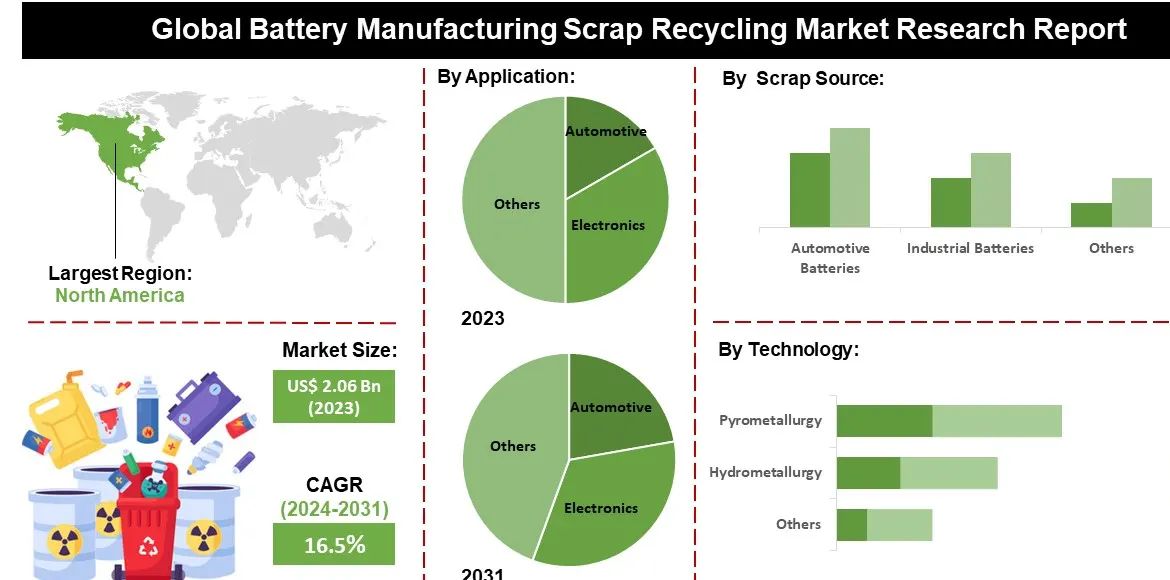

Demand for recycled materials is skyrocketing too. Lithium, cobalt, and nickel—key battery metals—are in short supply, with prices swinging wildly. Recycling offers a steady, local source, cutting reliance on volatile mining regions. In 2023, lithium-ion battery recycling was valued at over $26 billion globally, with projections hitting $54 billion by 2030. That’s a compound annual growth rate (CAGR) of over 10%, fueled by EoL growth and green policies. The takeaway: battery scrap isn’t just waste—it’s a lifeline for the clean energy boom.

Demand Drivers: EVs and Energy Storage Lead the Charge

What’s fueling this market? Two words: electrification and storage. EVs are the big dog—global sales topped 17 million in 2024, each packing a battery ripe for recycling down the line. The International Energy Agency pegs battery demand at over 1 terawatt-hour (TWh) annually, with EVs eating up 85% of that. As these vehicles age, their batteries will pile up, driving scrap volumes sky-high. Meanwhile, energy storage systems (ESS) for solar and wind are ballooning, adding another layer of demand. These systems rely on big batteries with finite lifespans, and when they’re done, recyclers swoop in.

Kathryn Murphy

Global Trade: A Shifting Puzzle

Battery scrap isn’t staying put—it’s crossing borders, and the trade map is getting messy. China dominates, recycling millions of tons domestically while importing scrap to feed its gigafactories. But tensions—like U.S.-China tariff spats—are crimping flows, with Chinese imports of U.S. scrap dipping in 2024. Europe’s stepping up, with players like Mercedes-Benz building hydrometallurgical hubs to process local scrap, cutting reliance on Asian supply chains. The U.S., meanwhile, is racing to onshore recycling, spurred by the 2022 Inflation Reduction Act and fears of material shortages.